is there a florida inheritance tax

Just because Florida does not have an inheritance tax does not mean you do not have to file taxes. For the estate tax a Florida resident or for that matter any United States citizen or resident alien may leave an estate with a value of up to 5340000 free of US estate tax or inheritance tax.

Florida Attorney For Federal Estate Taxes Karp Law Firm

Estate tax is a tax levied on the estate of a person who owned property upon his or her death.

. A very small number of states have inheritance taxes and again Florida is not one. There are exemptions before the 40 rate kicks. Also known as estate tax or death tax the inheritance tax is.

There is no federal inheritance tax but there is a federal estate tax. Fortunately Florida is not one of these states and it does not have a specific. There are several other tax filings that the survivor must complete and they include the.

In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from 18 to 40. The estate of a deceased person in Florida could still owe federal inheritance taxes if the value of estate is over the lifetime limit. As mentioned above the State of Florida doesnt have a death tax but qualifying Florida estates are still responsible for the federal estate tax there is no federal inheritance tax.

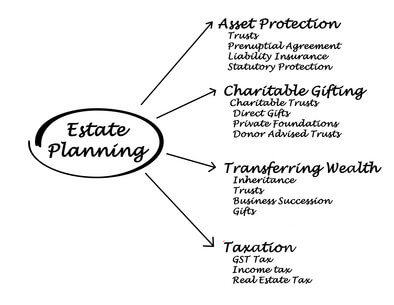

Yes there are tax concerns for those who receive an inheritance in Florida in addition to the federal inheritance tax guidelines. An inheritance tax is a tax levied against the property someone receives as an inheritance. While there are fees and expenses associated with the probate process in Florida the state has no inheritance tax.

There is no inheritance tax or estate tax in Florida. Florida doesnt collect inheritance tax. In some states there is what is known as an inheritance or death tax on the estate of the deceased.

Yet some estates may have to pay a federal estate tax. Of course you could always sell the item but if more than one beneficiary inherits the home or piece of real property it generally has to be a group decision. Some people are not aware that.

An inheritance tax is a tax on assets that an individual has inherited from someone who. The State of Florida does not have an inheritance tax or an estate tax. Since Floridas estate tax was based solely on the federal credit estate tax was no longer due on estates of decedents that died on or after January 1 2005.

Beneficiaries need to be mindful of the following situations. Inheritance Tax in Florida. Florida also does not have a separate state estate tax.

If someone dies in Florida Florida will not levy a tax on. Its against the Florida constitution to assess taxes on inheritance no matter how much its worth. As of 2020 only six states impose an inheritance tax on its residents but Florida is not one of them.

Florida Inheritance Tax and Gift Tax. While many states have inheritance taxes Florida does not. This means if your mom leaves you 400000 you get 400000 there are no.

This tax is different from the inheritance tax which is levied on money after it has been passed on to the deceaseds heirs.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

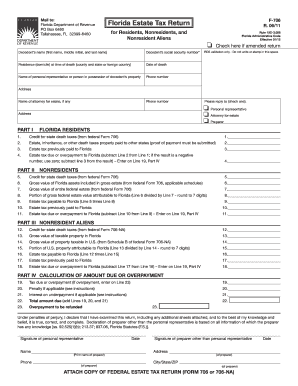

Florida Estate Tax Return F 706 Fillable Online Form Fill Out And Sign Printable Pdf Template Signnow

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Will My Florida Estate Be Taxed Nici Law Firm P L Naples Fl

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Is There An Inheritance Tax In Florida And Will You Have To Pay The Handy Tax Guy

Taxes In Florida Does The State Impose An Inheritance Tax

Florida Probate Tax Stuart Probate Lawyer John Mangan Can Help

/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

Estate And Inheritance Taxes Around The World Tax Foundation

Widowed Florida Resident Wants To Move Closer To Family But Worries About Impact On Estate Taxes

How Much Is Inheritance Tax Community Tax

Inheritance Tax Here S Who Pays And In Which States Bankrate

Relocating To Florida Understanding Estate Taxes On Your Property The Lynch Law Group Llc Attorneys In Cranberry Twp And Pittsburgh

What You Need To Know About Estate Tax In Florida St Petersburg Estate Planning Lawyers

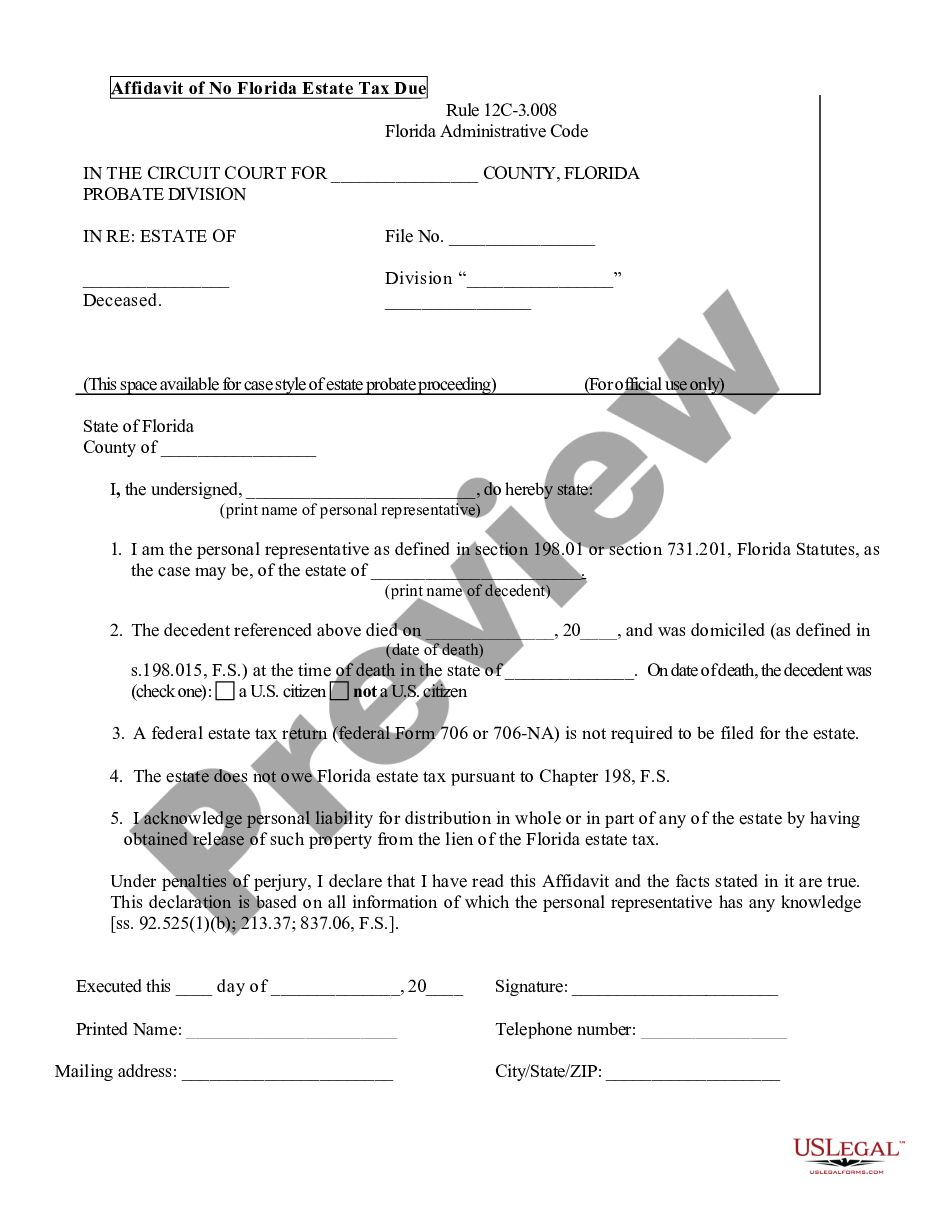

Affidavit Of No Florida Estate Tax Due

Florida Trust May Protect Heirs From Large Estate Tax

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation